Tracking your miles for your trips is a must for tax purposes to claim business mileage deduction and business mileage reimbursement. Aside from these, there is also a medical expense deduction. This is one of the tax reasons for you to keep your mileage log.

For medical expense deduction, you can deduct only the amount of your total medical expenses if it is more than 7.5% of your adjusted gross income (AGI). You can refer to Schedule A (Form 1040) and this will allow you to itemize your deductions accurately. The IRS standard mileage rates for 2023 for medical mileage deduction is:

- 16 cents per mile driven

For 2022, it’s 16 cents per mile driven. You may check the IRS standard mileage rates for the previous years to see the rate changes.

You can include your drives to pick up prescriptions, medical appointments, and other health-related activities.

The following are the IRS allowable transportation costs on medical expense deduction that are primarily for and essential to medical care:

- Train, bus, taxi, or plane fares or ambulance service

- Transportation costs of a parent who must go with a child who needs medical care

- Transportation expenses of a nurse or other person who can provide the treatment required by a patient who is traveling and is unable to travel alone and anytime can need medical care

- Transportation expenses for routine visits to see a mentally ill dependent – this is allowed by the IRS only if the visits are a recommended part of the treatment

For car expenses, you can include:

- the cost of gas and oil

- parking and toll fees

provided the vehicle was used for medical purposes.

You can’t include the following:

- depreciation, insurance, maintenance, or general repair

expenses

Keep in mind that price results will fluctuate based on local gas prices, that is why it is necessary to keep a record of all your drives. Just like with business mileage deductions and the likes, you’ll need proper documentation to make your claims valid.

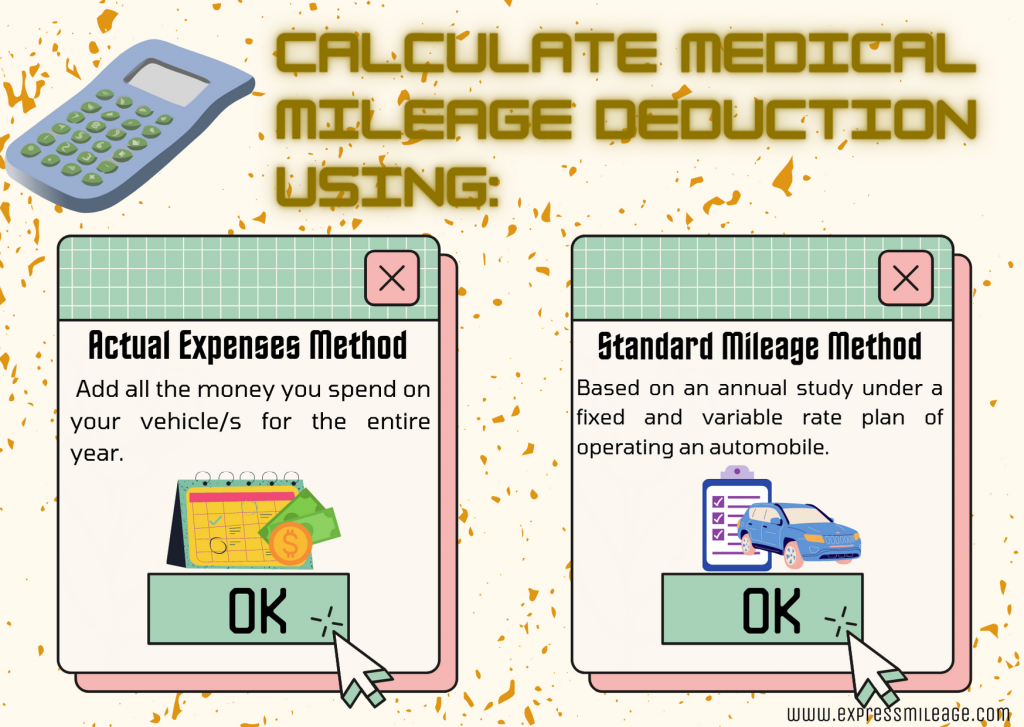

In calculating your medical mileage deduction you can use the actual expense method or the standard mileage method, or you can use both and see which one you prefer. You can go if you see a larger deduction than the other method. You can seek professional help from your tax attorney or CPAs. You can ask unfamiliar things and discuss your rights and responsibilities on claiming medical mileage deductions and what you can do in case you face an audit. It is highly advised to seek guidance from an experienced Tax Lawyer and CPA.

You can’t include the following situations:

- Traveling to and from work, even if your medical condition necessitates an unconventional mode of transportation.

- Travel to another city for strictly personal reasons, such as surgery or other medical treatments.

- Travel with the sole purpose of improving one’s health.

- The expenses of operating a particularly modified automobile for purposes other than medical.

For a reliable and verified system to meet the IRS log, the ExpressMileage can be your driving buddy for an easier and convenient way of organizing mileage logs for the entire year. You can also visit the Express Mileage FAQ page for additional information. Signing up is FREE!