But lots of people forget to track mileage until it’s too late.

If that’s you, don’t panic. You can rebuild a mileage log for 2025. You just need to be realistic, gather proof, and create a log that makes sense.

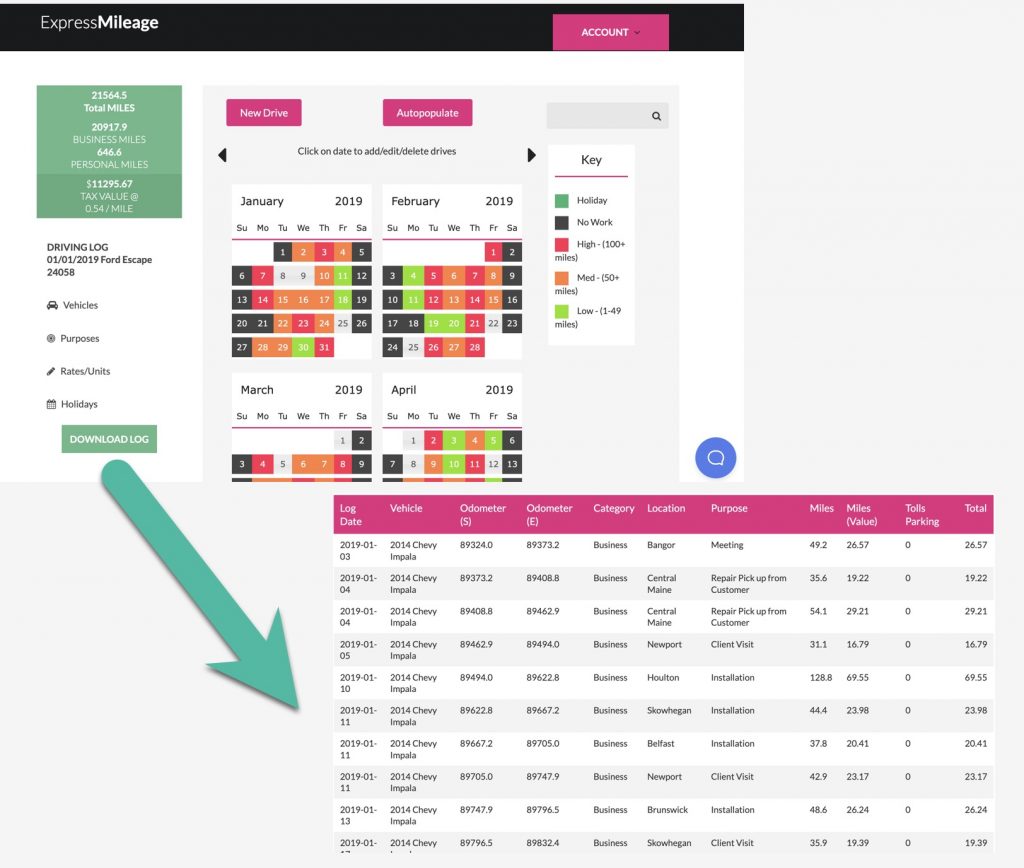

Need a mileage log fast? ExpressMileage helps you generate a clean, professional mileage log in minutes.

Step 1: What the IRS wants (in plain English)

The IRS generally expects you to keep a mileage log with details like:

- Date of the trip

- Where you went (start/end location)

- Business purpose

- Miles driven

- Your vehicle’s total miles for the year (business + personal)

If you didn’t keep perfect records, you can still try to reconstruct them. But you should have

supporting evidence—not just a guess.

Helpful IRS resources:

Publication 463 (Travel, Gift, and Car Expenses),

Topic No. 510 (Business use of car),

and the

IRS standard mileage rates page.

Step 2: Supporting evidence to gather (this is the key)

Here are the best sources to rebuild your 2025 mileage log:

1) App records (Uber/Lyft/DoorDash/Instacart, etc.)

Most gig apps show trip history and earnings summaries. These can help prove:

- days you worked

- general locations

- minimum miles (often only “on-trip” miles)

Important: App logs often miss real business miles like driving to your first pickup, driving between trips, and driving home.

2) Bank + credit card statements

These can support patterns like gas purchases, parking, tolls, and car-related expenses.

3) Maintenance and service receipts (great for odometer readings)

Oil changes, repairs, inspections—these often include an odometer reading, which helps you estimate total miles for the year.

4) Calendar events, emails, and texts

Appointments and confirmations with dates/locations can help verify business travel.

5) Google Maps Timeline (if it was on)

Timeline isn’t perfect, but it can help you rebuild where you went on certain days.

Pro tip: Put all your evidence into one folder (PDFs, screenshots, exports). If you ever need it, you’ll be glad it’s organized.

Step 3: Rebuild your mileage in a smart, defensible way

You don’t need to recreate every single drive perfectly. You need a log that is reasonable and supported.

Option A (best): Rebuild using real “trip days”

- Identify the days you worked or traveled for business.

- For each day, estimate mileage using trip history locations, receipts, and known routes.

- Add a note explaining how you calculated it.

Option B: Use a “sample period” and extrapolate (only if you can back it up)

If you don’t have full records, you can use one normal month (or a few weeks) where you do have evidence,

then estimate other months—as long as you have proof those months were similar (earnings reports, schedules, consistent gas patterns).

Keep it conservative. Overestimating miles is a common reason deductions get questioned.

Ready to turn your notes into a clean log?

See how ExpressMileage works

or

watch a quick example.

Step 4: Don’t forget total miles for the year

When you claim a mileage deduction, it helps to know your total miles driven for the year (business + personal).

Typically this comes from odometer readings:

- Odometer at the start of 2025

- Odometer at the end of 2025

If you didn’t record those, check service receipts near the beginning/end of the year or any inspection paperwork that shows mileage.

Want a template to keep this simple next time?

Download free mileage log templates (Excel/PDF/Sheets).

Words of caution

Reconstructed logs can be accepted, but they can also get extra scrutiny. Be smart:

- Don’t inflate miles. Conservative is safer.

- Keep your evidence. Save statements, receipts, and app exports.

- Be consistent. Your log should match your work pattern and income.

- When in doubt, ask a tax pro. Especially if the deduction is large.

How to avoid this in 2026

Rebuilding a full year is stressful—and you’ll almost always miss some deductible miles.

The easiest win is to start tracking now so your 2026 taxes are simple.

A simple habit that works

Pick one day each week (like Sunday night) and update your mileage. Even weekly logs are far better than trying to recreate a year later.

If you want the easiest path, use ExpressMileage to keep everything organized and export-ready:

Get started with ExpressMileage

|

Read FAQs

|

See plans

FAQ

Can I still claim a mileage deduction if I didn’t track mileage in 2025?

You may be able to, but you should reconstruct a reasonable log and keep supporting evidence (app records, receipts, service records, calendar entries).

Do Uber/Lyft miles count even when I don’t have a passenger?

In many cases, miles driven for business (like driving to a pickup or between jobs) can be business-related—but you need reasonable support for what you claim.

What’s the best way to make a mileage log quickly?

If you already have evidence and just need a clean log, a mileage log generator like

ExpressMileage.com

can help you put it together in minutes.

Where can I get a free template?

Here are free templates you can use:

IRS printable mileage log templates (Excel/PDF/Sheets).