1. Understand the Importance of Mileage Deductions

Mileage deductions allow self-employed individuals and gig workers to subtract certain vehicle-related expenses from their taxable income. This deduction acknowledges the costs incurred while using your personal vehicle for business purposes, thereby lowering the amount of income subject to taxation.

2. Choose the Appropriate Deduction Method

The IRS offers two primary methods to calculate your vehicle-related deductions:

- Standard Mileage Rate: This method involves multiplying the number of business miles driven by a standard rate set by the IRS. For the tax year 2025, the rate is 70 cents per mile. This approach simplifies record-keeping, as you only need to track your business mileage. Check the most recent rates: IRS Standard Mileage Rates

- Actual Expense Method: This method requires you to calculate the actual costs of operating your vehicle for business purposes. Deductible expenses include gas, oil, repairs, insurance, depreciation, and other related costs. You’ll need to determine the percentage of time your vehicle is used for business versus personal purposes and apply that percentage to your total vehicle expenses.

3. Maintain Accurate Records

Regardless of the method chosen, meticulous record-keeping is essential:

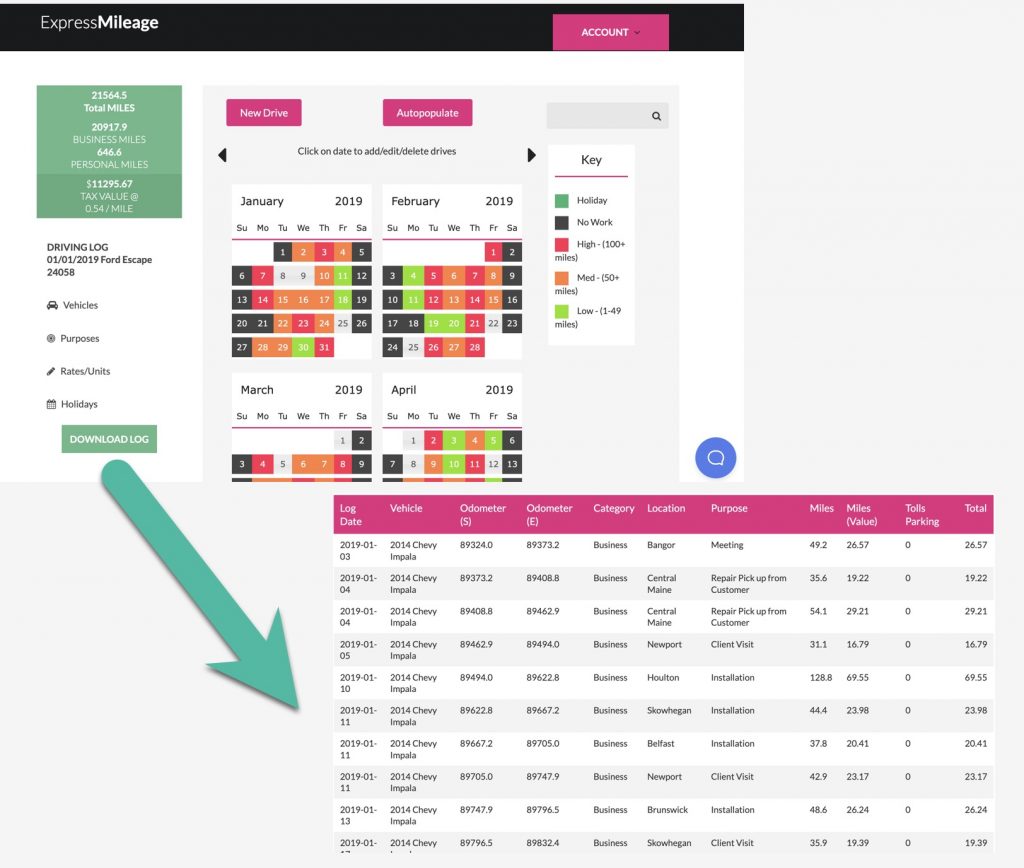

- For Standard Mileage Rate: Keep a detailed log of all business-related trips. This log should include the date, purpose of the trip, starting point, destination, and miles driven. Utilizing a mileage tracking app can automate this process, ensuring accuracy and convenience.

- For Actual Expense Method: Retain all receipts and documents related to vehicle expenses. Organize records of fuel purchases, maintenance bills, insurance payments, and any other costs associated with operating your vehicle.

4. Calculate Your Deduction

- Standard Mileage Rate: Multiply your total business miles driven by the IRS rate. For example, if you drove 10,000 miles for gig work in 2025, your deduction would be 10,000 miles × $0.70/mile = $7,000.

- Actual Expense Method: Sum up all vehicle-related expenses and multiply by the percentage of business use. If your total expenses are $5,000 and 60% of your vehicle use is for business, your deduction would be $5,000 × 60% = $3,000.

Effortless. IRS Compliant. All in 5 Minutes.

- GENERATE A DRIVING LOG IN MINUTES

- AUTO-POPULATE AND RECURRING DRIVES

- GET YOUR MAXIMUM TAX DEDUCTION

5. Report on Your Tax Return

As a gig worker, you’ll typically report income and expenses on Schedule C (Form 1040), Profit or Loss From Business. IRS Schedule C Form Enter your calculated mileage deduction on the appropriate line for car and truck expenses. Ensure all other related expenses are also reported accurately.

6. Be Aware of IRS Requirements

The IRS mandates that all mileage deductions be substantiated with adequate records. Inadequate documentation can lead to disallowed deductions and potential penalties. Consistently maintaining detailed and accurate records not only supports your deduction claims but also provides a reliable reference in case of an audit.

7. Consider Additional Resources

Given the complexities of tax laws and the potential for changes, it’s advisable to consult with a tax professional or utilize reputable tax software. They can provide personalized guidance tailored to your specific circumstances, ensuring compliance and optimization of your deductions.

8. Stay Updated on IRS Guidelines

Tax regulations and standard mileage rates can change annually. Regularly review the latest IRS publications or official website to stay informed about current rates and any modifications to deduction rules. This proactive approach ensures you’re always maximizing your potential savings.

By diligently tracking your mileage and understanding the available deduction methods, you can effectively reduce your taxable income, leading to significant tax savings. Implementing these practices not only ensures compliance with IRS regulations but also enhances the financial efficiency of your gig work endeavors.

Mileage Deduction Resources

To further assist you in understanding and maximizing mileage deductions for your gig work, here are some valuable external resources:

- IRS Standard Mileage Rates: Stay updated with the latest mileage rates set by the IRS to ensure accurate deductions.

- IRS Publication 463 (Travel, Gift, and Car Expenses): This comprehensive guide provides detailed information on deductible vehicle expenses and the requirements for claiming them.

- IRS Schedule C (Form 1040): Understand how to report your income and expenses, including car-related deductions, as a self-employed individual.

- IRS Self-Employed Individuals Tax Center: A hub of resources tailored for self-employed workers, offering insights into tax obligations, deductions, and record-keeping.

These resources will provide you with authoritative information to help you navigate mileage deductions effectively and ensure compliance with tax regulations.