Introduction to Mileage Logging

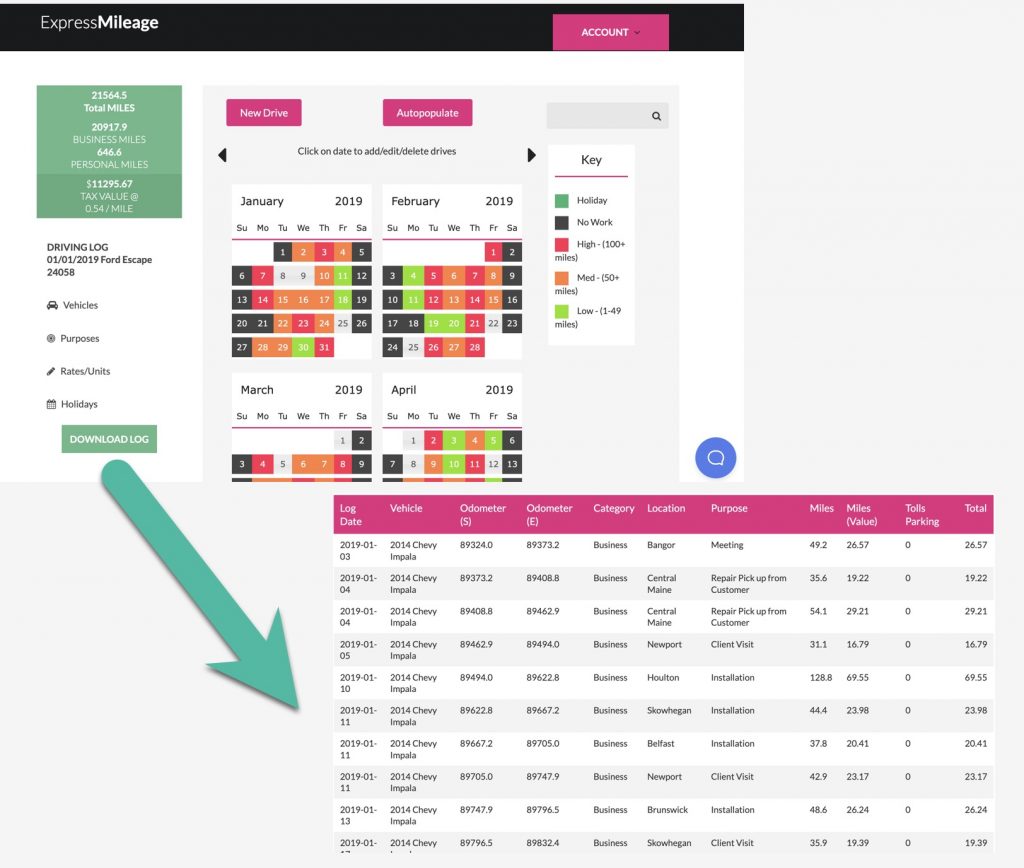

In today’s digital age, various technologies simplify our lives, yet some still prefer traditional methods like writing a mileage logbook manually. Whether you choose to use pen and paper or a digital application, understanding the importance of maintaining accurate mileage records for business purposes is crucial. For those interested in digital solutions, ExpressMileage offers an advanced app that ensures flawless printable mileage logs.

Historical Perspective: Paper Mileage Logs

The practice of tracking mileage using paper logs dates back to the early days of automobile use when businesses needed a way to account for travel expenses. Initially, drivers would jot down their start and end points along with the date and purpose of the trip in notebooks. This method was not only time-consuming but also prone to errors. As the need for more accurate and reliable record-keeping grew, especially for tax deductions, digital solutions began to emerge, revolutionizing how mileage logs were maintained.

Need a mileage log for taxes or reimbursement?

Make a log in 5 minutes worth $$$

Understanding Mileage Rates and Logbooks

The Standard Mileage Rate

Most contractors, small business owners, and self-employed individuals prefer using the standard mileage rate for calculating mileage deductions. This method, recommended during the first year of business vehicle use, allows for future flexibility in accounting methods. For 2023, the IRS allows a deduction of 65.5 cents per mile for business travel, which can significantly reduce your taxable income if you drive frequently for business.

IRS Mileage Log Requirements

To comply with IRS guidelines, your mileage log must include:

- The date and purpose of each trip.

- Starting and ending locations.

- Ownership or lease information of the vehicle used.

- While not mandated, recording the odometer reading at the start and end of each year, as well as monthly or at refuelings, is advised to support your log’s accuracy.

Is a Logbook Necessary?

Although traditional paper logs are still accepted, digital logs created through apps are becoming the standard due to their ease and reliability. ExpressMileage, for instance, offers an app that not only tracks your mileage automatically but also generates IRS-compliant logs that can be printed if needed.

Paper vs. Digital Mileage Logs: A Comparison

Benefits of Using a Mileage Logbook App

Digital mileage logbooks, like those offered by ExpressMileage, provide numerous advantages over paper logs:

- Error Reduction: Digital logs help minimize mistakes through features like AI-assisted data entry and error correction based on historical odometer readings.

- Efficiency: Automatic tracking via Bluetooth or mobile plugins saves time, eliminating the need to manually record each trip.

- IRS Compliance: Digital logs are designed to meet IRS requirements effortlessly, reducing the risk of audit complications.

Situations Requiring Retrospective Logs

If you find yourself needing past records for an IRS audit and you’ve been using paper logs, you may face challenges reconstructing accurate logs. Digital solutions allow you to recreate compliant logs as long as you have basic information like odometer readings and typical travel routes.

Choosing the Right Mileage Tracking Solution

ExpressMileage stands out as a leading provider of mileage tracking solutions. Their app not only simplifies the process of log creation but also ensures that you spend minimal time on this task, thereby saving money in the long run.

For those looking to compare different apps, ExpressMileage provides a detailed comparison table that showcases the features and benefits of their software against competitors.

Conclusion

Whether you opt for a traditional paper log or a modern digital app, maintaining an accurate mileage log is essential for business efficiency and tax compliance. As digital solutions continue to advance, they offer significant advantages in terms of accuracy, convenience, and security.

For more information on mileage tracking and to download templates or try digital solutions, you can visit:

By staying informed and choosing the right tools, you can ensure that your mileage logging is both efficient and compliant, paving the way for a smoother tax filing process.