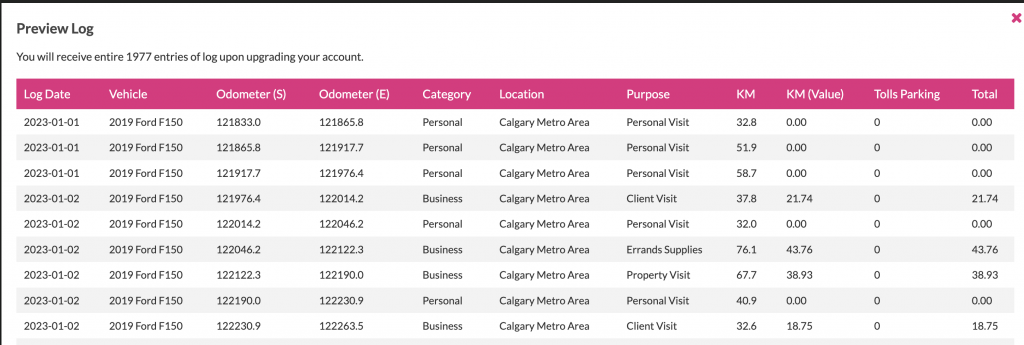

When you’re audited by the IRS for mileage deductions, you are generally expected to provide documentation that substantiates your claimed expenses. For mileage deductions, the IRS requires you to keep a detailed mileage log rather than proof of the odometer reading at the beginning and end of the year. This log should include:

Elements of a Mileage Log

- The Date of the Trip: Each business trip’s date.

- The Mileage for Each Trip: The number of miles you drove for business.

- The Places You Drove for Business: The destination of each trip.

- The Business Purpose for the Trip: A brief description of the business reason for each trip.

- The Vehicle’s Starting Mileage: This can be at the beginning of the year or when you first start using the vehicle for business purposes.

- The Vehicle’s Ending Mileage: At the end of the year or when you stop using the vehicle for business purposes.

While the IRS doesn’t specifically require “proof of odometer” for each business trip, they do require your total business miles for the year, which involves knowing your starting and ending odometer readings. It’s beneficial to take a photo of your odometer at the beginning and end of the year as part of maintaining comprehensive records.

In addition to the mileage log, keeping receipts related to your vehicle (such as gas, maintenance, and insurance) can be helpful, especially if you decide to calculate your deduction using actual expenses instead of the standard mileage rate. However, for the standard mileage deduction, the detailed log is the primary document you should maintain.

Effortless. IRS Compliant. All in 5 Minutes.

- GENERATE A DRIVING LOG IN MINUTES

- AUTO-POPULATE AND RECURRING DRIVES

- GET YOUR MAXIMUM TAX DEDUCTION

What happens if you get audited by IRS and don’t have a mileage log?

If you find yourself facing an IRS audit without a mileage log, you could be at significant risk of having your vehicle expense claims denied. This scenario can lead to costly tax adjustments and potential penalties. The IRS requires concrete documentation to support any deductions claimed on your tax returns, and without a properly maintained mileage log, validating your automobile expenses becomes nearly impossible. Adhering to the recommended practices for logging your miles is not just advisable; it’s essential for ensuring that you can defend your claims under scrutiny. Maintaining a comprehensive and IRS-compliant mileage log is the best defense against audit-related disputes, providing you with the necessary evidence to substantiate your deductions and safeguard your financial interests.

How to Survive an IRS Audit

Remember, the key to surviving an IRS audit is maintaining thorough and accurate records. The IRS may not always ask for every piece of documentation, but having it available is crucial. If you didn’t keep a detailed log, you might need to reconstruct it to the best of your ability using other records, like appointment books, calendars, or receipts.

For the most accurate and personalized advice, consider consulting with a tax professional or an accountant familiar with IRS audits and mileage deductions.