Who Needs a Mileage Log? If you’re driving for work, whether as an employee, a self-employed individual, or an employer looking to simplify mileage recording for your team, the IRS mileage log template for 2025 is essential. This template will help you track your business-related mileage efficiently.

If you forgot to keep a log (or have an incomplete log) for last year, check out this info

What to Do If You Didn’t Track Mileage

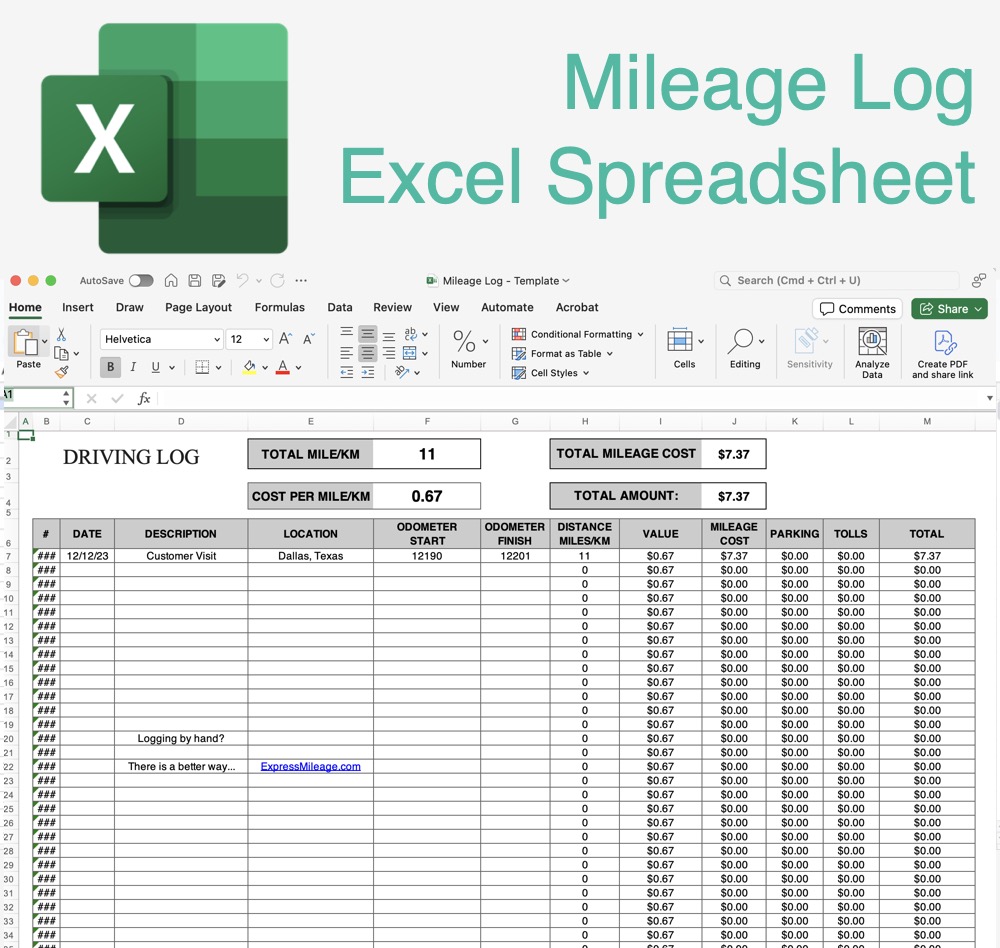

Benefits of Using a Printable Mileage Log for 2025 The downloadable mileage log template aligns with the IRS standard mileage rate for 2025 – which is 70 cents per mile for business driving. To ease your work, choose from different formats: a modifiable Excel file, a quick PDF version, or even a Google Sheets version. Remember, if using Google Sheets, you’ll need to make a copy of the template since the original is view-only.

Effortless Mileage Tracking Tracking mileage might seem daunting, but using a template can simplify the process. It ensures you capture all crucial details such as date, destination, purpose, and mileage for each business trip. This not only prepares you for IRS reporting but also helps in managing comprehensive records for reimbursements or audits.

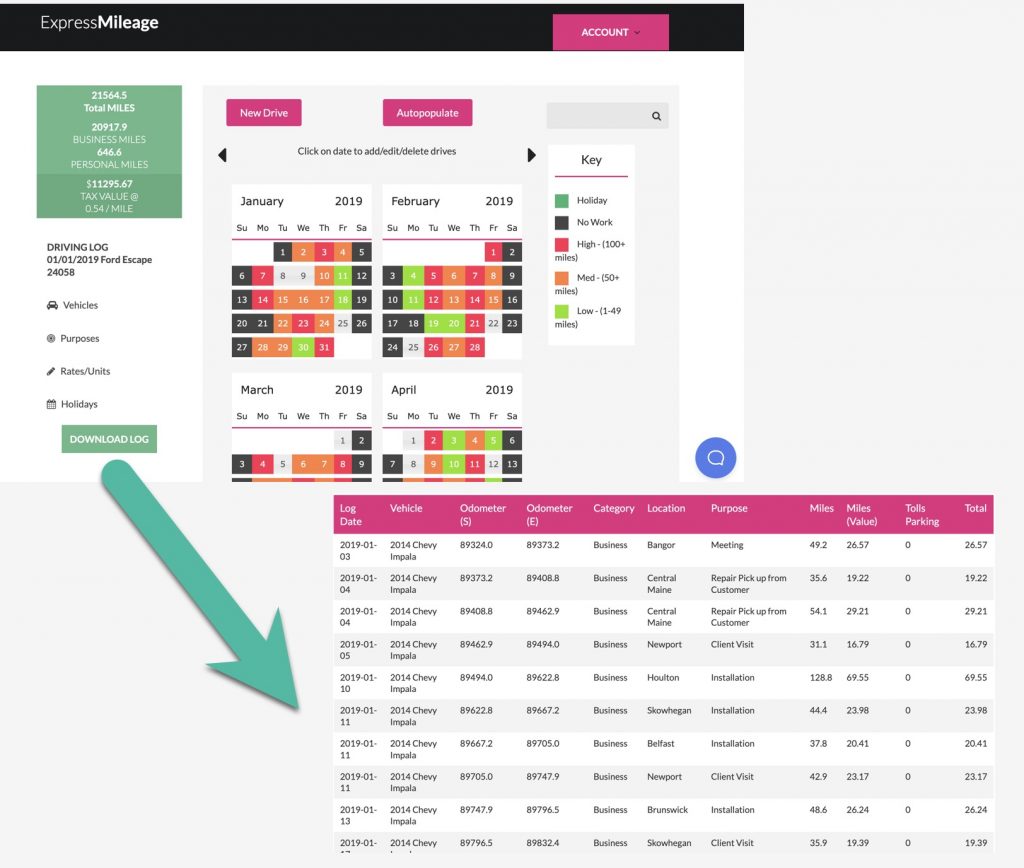

Learn more about why ExpressMileage is best way to create a mileage log in 2025.

Effortless. IRS Compliant. All in 5 Minutes.

- GENERATE A DRIVING LOG IN MINUTES

- AUTO-POPULATE AND RECURRING DRIVES

- GET YOUR MAXIMUM TAX DEDUCTION

How to Utilize the Mileage Log Template A mileage log serves as a detailed record of your business-related travels required by the IRS or employers for tax deduction or reimbursement purposes. You need to log every trip, noting down specifics like miles driven, trip date, destination, and the purpose of each journey.

Key IRS Mileage Rates for 2025

- Business use: 70 cents per mile.

- Medical or moving purposes for Armed Forces: 21 cents per mile.

- Charitable service: 14 cents per mile.

Documenting Your Miles Proper documentation is crucial. The IRS requires timely updates to your mileage log, ideally weekly. The log should include:

- Mileage for each business trip.

- Date of the trip.

- Destination and purpose.

- Total annual mileage.

Recommendations for Keeping Mile Logs To avoid issues during audits, it’s wise to regularly update and back up your mileage logs. The IRS mandates keeping these logs for three years from your tax filing date. While paper logs are acceptable, digital solutions like ExpressMileage are recommended for efficiency and compliance.

Automating Mileage Tracking Consider using apps like Driversnote or MileIQ, which automatically track your driving, saving you the hassle of manual entries. These apps document every detail of your trips, making mileage reports accessible with just a few clicks.

By integrating these practices, you ensure meticulous record-keeping, making it easier to handle business expenses and prepare for potential IRS audits.