If you have received notice that the IRS is auditing you and requires substantiation of your Schedule C deduction – we can help!

We’ve assembled some of the common questions we encounter when helping people build mileage logs for audit purposes. Our goal at ExpressMileage is to assist you in building the highest quality mileage log that will withstand IRS audit and NOT be rejected.

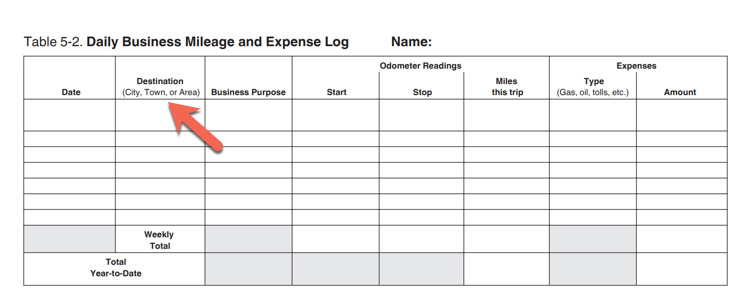

Do I need to provide specific addresses in my driving log?

The IRS states you are required to capture the Location or Destination of your drives. IRS Publication 463 shows a suggested log format with : ” Destination (City, Town, or Area) .” Providing the general area (ie: “Chicago Metro Area”) for your driving is completely acceptable. Remember, the more specific your Location becomes – the more easily an auditor can deconstruct your log and look for inconsistencies.

Sample driving log format from IRS Publication 463

Do I need to provide additional supporting material (oil change receipts, credit card statements..etc) to the IRS to validate my log?

Auditors often attempt to overstep the boundary of required information for Schedule C deductions. They may ask for additional documentation above and beyond your mileage log to help substantiate your driving log submission. Fortunately for you – the IRS does not have the authority to request this additional information.

When asked for any additional supportive material – this response is often best to counter the request:

I would be happy to provide you the information you are asking for – but I need to understand which regulation or ruling which states that this additional information is required in order to validate my driving log. I’m looking at Publication 463 right now and I don’t see where that information is required.

Do I need to have Business and Personal mileage in my log?

It is extremely rare to use a vehicle for 100% business use. Extremely rare. At some point during your business day, you are likely going to have some kind of personal usage of your business vehicle: picking up your kids from school, driving to drop-off a book to your neighbor..etc.

A vehicle mileage log with ZERO personal miles is an IRS audit RED flag. Consider your regular driving habits and be sure you include personal miles in your log.

Do I need every drive documented (One-Way) or can I use Round Trip values in my mileage log?

You are able to use Round Trip values for your mileage log. This greatly simplifies log keeping and reduces the number of log entries.

As defined by the IRS in Publication 463:

Car expenses. You can account for several uses of your car that can be considered part of a single use, such as a round trip or uninterrupted business use, with a single record. Minimal personal use, such as a stop for lunch on the way between two business stops, isn’t an interruption of business use.

Example. You make deliveries at several different locations on a route that begins and ends at your employer’s business premises and that includes a stop at the business premises between two deliveries. You can account for these using a single record of miles driven.

What if I started using a 100% personal vehicle to Business use mid-way through the year? Do I need a mileage log?

Good question. You will still need a log for the Business use after the vehicle started to be utilized for business. For the mileage before the date (when the vehicle was 100% personal) can be estimated in the following way:

As defined by the IRS in Publication 463:

Change from personal to business use.

If you change the use of a car from 100% personal use to business use during the tax year, you may not have mileage records for the time before the change to business use. In this case, you figure the percentage of business use for the year as follows.

-

Determine the percentage of business use for the period following the change. Do this by dividing business miles by total miles driven during that period.

-

Multiply the percentage in (1) by a fraction. The numerator (top number) is the number of months the car is used for business, and the denominator (bottom number) is 12.

Example. You use a car only for personal purposes during the first 6 months of the year. During the last 6 months of the year, you drive the car a total of 15,000 miles of which 12,000 miles are for business. This gives you a business use percentage of 80% (12,000 ÷ 15,000) for that period.