Did you know the IRS allows you to utilize a smaller sample of your annual mileage log? Yes! It’s true and can save you an enormous amount of time and money.

You can use a 3-month (90-day) sampling of your driving as proof of your driving habits for the entire year and deduct your business miles the entire year using the Standard Deduction Rate. This sampling method assumes you utilize your vehicle throughout the year at the same rate/amount per month.

Effortless. IRS Compliant. All in 5 Minutes.

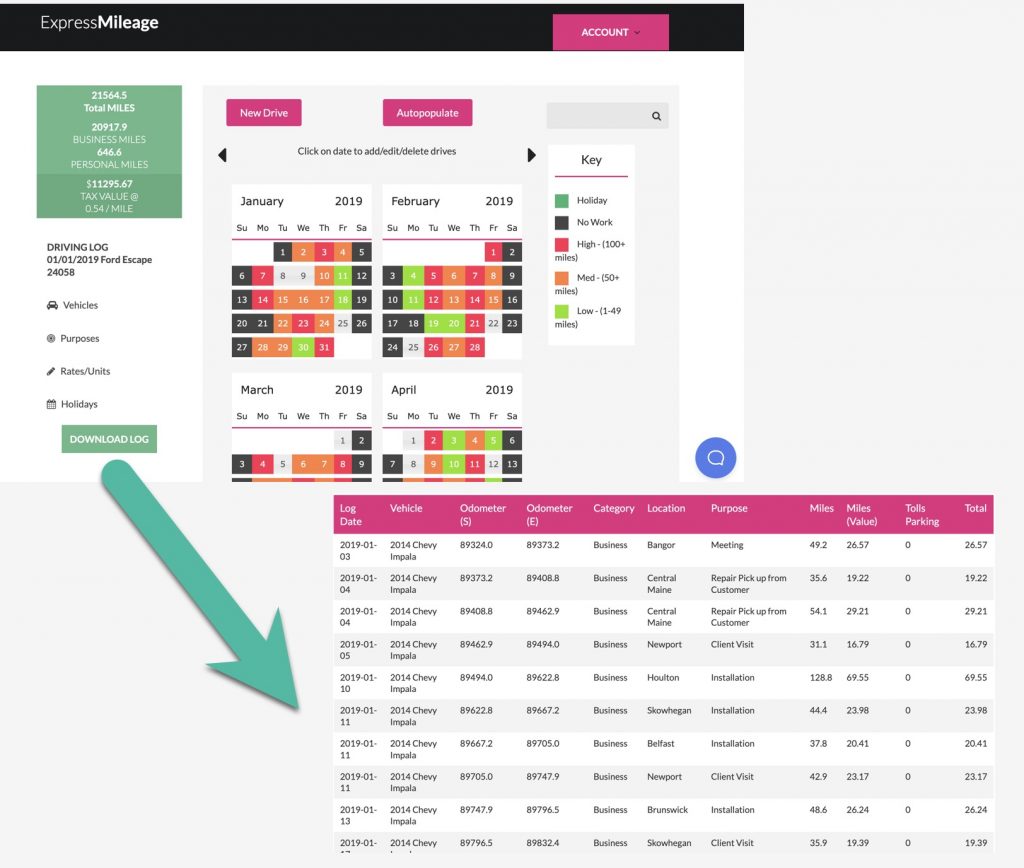

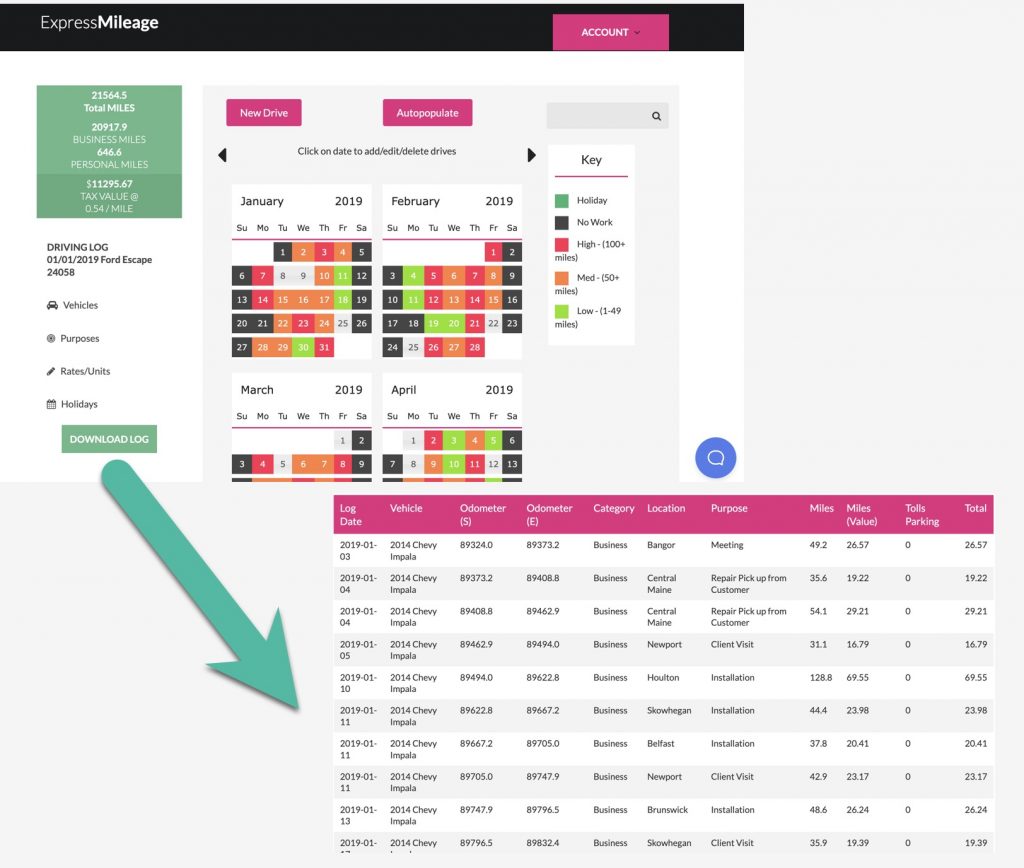

- GENERATE A DRIVING LOG IN MINUTES

- AUTO-POPULATE AND RECURRING DRIVES

- GET YOUR MAXIMUM TAX DEDUCTION

Need a mileage log for taxes or reimbursement?

Make a log in 5 minutes worth $$$

Criteria for using the sampling method for mileage logs

- The taxpayer must use his/her vehicle for business purposes AND personal use

- You must keep record of your Start Odometer reading at beginning of year (Jan 1) and Ending Odometer reading (Dec 31)

- Invoices/bills must indicate vehicle usage remained steady throughout the year. (example: total gas receipts roughly the same each month OR oil changed at same 3-month interval)

- You must subtract out any abnormalities within the grand total of miles (ie: a long distance road-trip vacation)

Example:

Darren is a medical device sales representative and keeps track of his mileage for a 90-day (3 month) period from March 1 until May 31. From this “sample” of his mileage – Darren calculates he drove 4000 miles for business and 2000 for personal use. Darren recorded his odometer readings at the beginning and end of the year and calculated 29181 miles for the entire year. Darren did take a road-trip in the summer that was 2500 miles long, so he subtracts that trip from the total (29181) to get 26681 miles for the year. Since Darren used his vehicle 67% of the time for business (calculated by: 4000 business miles / 6000 total miles), he can claim 17876 business miles for the year. Since the Standard Rate is $.58 / mile the year he is tracking, Darren claims $10368 as his deduction for his business driving..

If you are creating a mileage log this can mean you can produce a smaller, more detailed log to utilize as your “sampling” log. However, if you are already able to generate a mileage log for the entire year – it is likely good practice to provide more data versus less data.

Who is the sampling method good for?

The sampling method works great for those people who consistently use their vehicle for business use throughout the year. It is probably not the best method for those who have seasonal fluctuations in their driving habits. Nor is the sampling method good if you changed businesses during the year which made your driving habits less predictable.

Need a mileage log for taxes or reimbursement?

Make a log in 5 minutes worth $$$