Keeping a mileage record for your medical travels is crucial as this will help you claim your medical mileage deduction. However, Internal Revenue Service or IRS considered medical care expenses are the following details:

- the expense for your medical diagnosis

- the expense for your cure or medicine (prescription is required)

- the expense for disease mitigation

- the expense for your medical treatment

- the expense for prevention of disease

- the expense for treatments affecting any part or function of the body

There are Allowable Medical Care Expenses Part I and Part II that some of it you might not know and can be helpful for your tax deductions. It is also significant to understand how to claim your medical expense deduction.

Here are the guidelines that you should do:

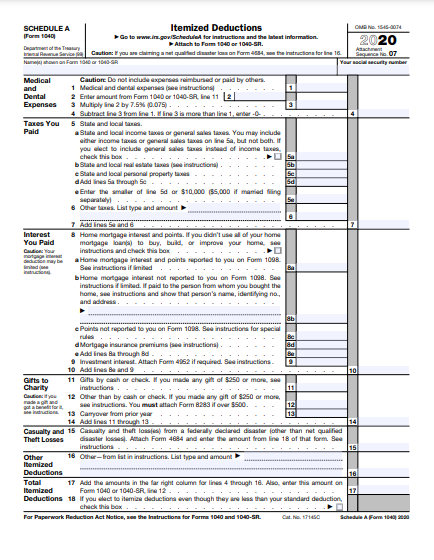

- Itemize your deductions on your taxes

To begin, instead of claiming the standard deduction, you must itemize. This may demand extra time spent on tax preparation, but if your standard deduction is smaller than your itemized deductions, you should itemize nevertheless to save money. To save time, use the standard deduction if it exceeds your itemized deductions. If you are pondering how much your standard deduction is, the Interactive Tax Assistant tool will help you determine in 5 minutes or less. The tool is intended for taxpayers who were US citizens or resident aliens for the whole tax year in concern. If married, both spouses must have been US citizens or resident aliens for the whole tax year. You may visit the International Taxpayers for details if you belong as nonresidents and dual-status aliens.

Itemizing deductions can be challenging however it is important to understand the IRS rules. Keep in mind that for medical expenses, you can deduct only the part that exceeds 7.5 percent of your Adjusted Gross Income (AGI).

- Utilize the Schedule A (Form 1040)

Schedule A allows you to compute your deduction by doing the arithmetic. Identifying each deduction will be simpler and more organized as the form is divided into different types of expenses. You can use your preferred tax software and it will guide you through the process. There is also an available IRS instruction for schedule A for your accurate reports.

- Maintain accurate records

Keep your receipts, invoices and always ask for records from your pharmacy or other medical providers to fill in the gaps. The IRS requires supporting documents for validation other than your medical mileage log. You have to keep every single purchase and expenditure so as in times of audit or need to address some concerns, your medical care expenses are appropriately documented.

On the other hand, you have to ensure that all your data from your mileage log maker are valid and no trace of fraud to avoid penalties and fines to the IRS. There are common errors for mileage logbooks, you have to make sure that names, figures, and other necessary details are recorded so as to avoid future dilemmas. An ExpressMileage is an online mileage log generator that can support you in tracking your mileage, and get the maximum tax deduction you deserve. It is proven, secured, and verified to meet the IRS record requirements. Visit the FAQ page for further details.