Making a mileage log for your medical trips is significant for you to get the medical mileage deduction. Using a mileage log maker like ExpressMileage can help you track everything effortlessly and accurately. Aside from the 10 Allowable Medical Care Expenses given last time, there are more on the lists for your reference. Keep in mind that you must meet the IRS percentage of adjusted gross income (AGI) 7.5% threshold.

- Transplantation of Organs (Organ Donation)

The expenditures incurred by the organ recipient, as well as those incurred by the donor, are tax-deductible (including transportation, tests, and hospitalization).

- Dietary Restrictions ( Special Foods)

Foods recommended by a doctor to address a medical condition like hypertension, obesity, and celiac disease may be partially deductible. Only the portion of the price that exceeds the cost of ordinary meals is tax-deductible.

- Travel Expenses going to Doctors, Treatment or Therapy Sessions and Drugstores

The cab or public transport costs can be deducted. You may then rely on the IRS standard mileage rate for 2021 if you are using your own car. Always keep in mind that you need to keep precise records for proper validation and to avoid errors.

- Program for Weight Loss

If a doctor validated that your present weight is a threat to your well-being, any prescribed weight reduction program can be deducted. However, general good health programs cannot be deducted. It must be addressed on what particular disease or diseases that you were diagnosed with.

- Costs for Special Education

Tax deductibles include programs dealing with the diagnosis of attention deficit hyperactivity disorder (ADHD), dyslexia, or autism. Any physical, mental or emotional situations that require medical attention.

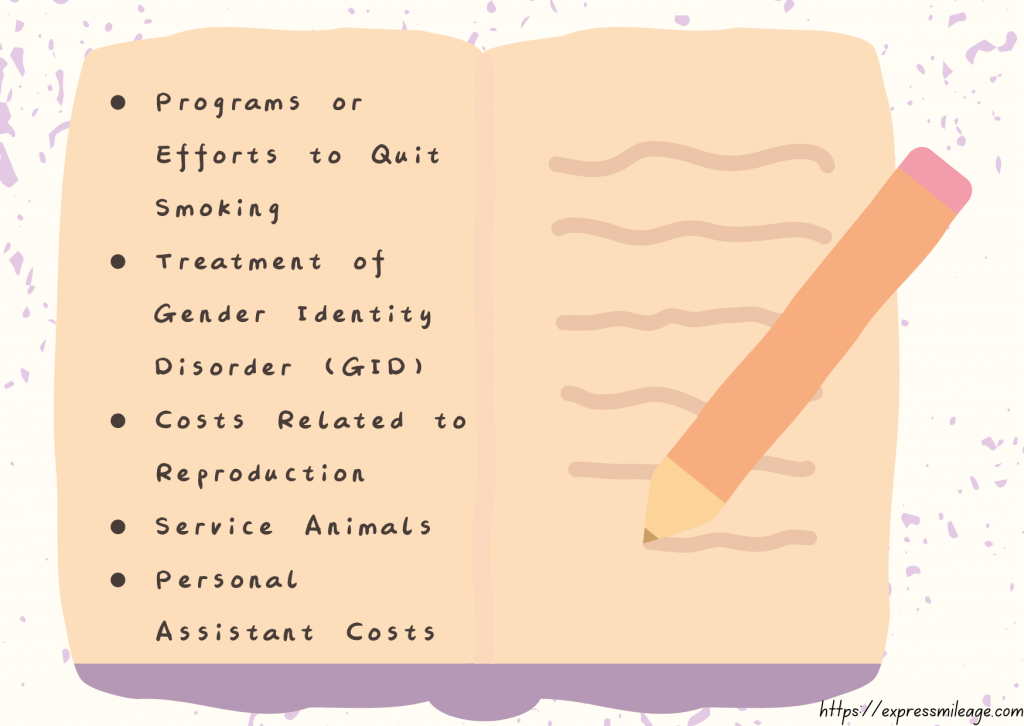

- Programs or Efforts to Quit Smoking

Deductible expenditures are only medical procedures prescribed by the doctor. Over-the-counter bases are not covered such as patches, gums, and other similar therapies.

- Treatment of Gender Identity Disorder (GID) such as Gender Reassignment Surgery and Hormonal Therapy

These are deductible treatments. However, even it is considered as part of a gender change, the expenses of breast augmentation operation cannot be deducted.

- Costs Related to Reproduction

This covers the expenses on contraceptive pills like birth control medicines, pregnancy test kits, vasectomies, abortions, and fertility medications such as IVF (In vitro fertilization), IUI (Intrauterine insemination), or Vasectomy Reversal.

Deductible costs include not just the original pricing but also the training fees, food, and veterinary charges for guide dogs and other service animals.

- Personal Assistant Costs

The cost of the care of someone unable to handle daily tasks is deductible. As a rule, the deductible part is restricted to personal help with everyday tasks including meals expenses, without the expense of housing or other activities, even if it is really difficult to separate them.

The medical expenses you paid can only be included throughout the year. Making a precise list can help track all your health-related expenses and identifying each item will be easier particularly those that are not covered by insurance and health reimbursement arrangement.

You may visit the Express Mileage FAQ page for further details.