Welcome to ExpressMileage, your comprehensive resource for navigating distance allowance and deductions in Canada. Here, you’ll find a curated collection of articles and resources that will guide you through the regulations on how to claim your distance allowance as an employee or as a self-employed individual. This is your one-stop source for understanding the CRA’s guidelines on motor vehicle logbooks.

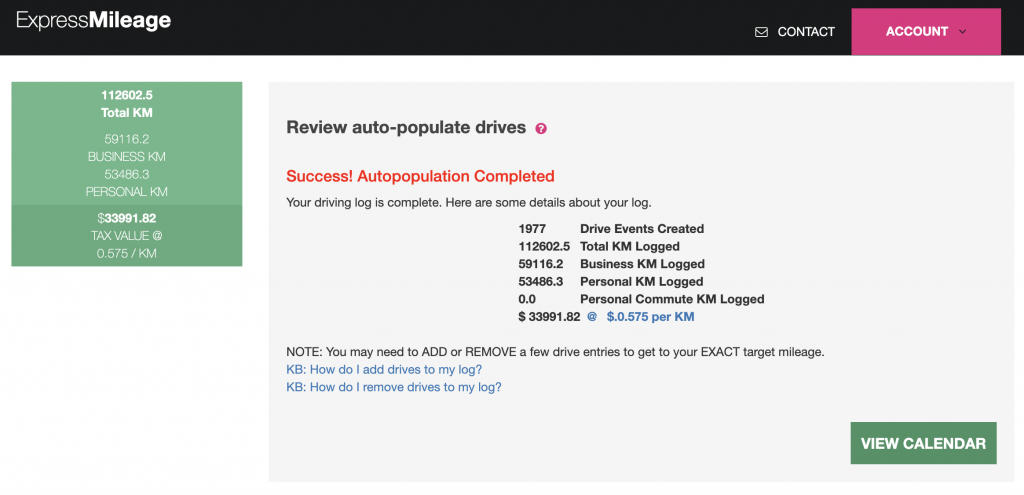

With ExpressMileage, effortlessly sharing your motor vehicle logbook with the CRA or your employer is just a click away. To streamline your experience, sign up for ExpressMileage.

CRA Automobile Allowance

Automobile allowance refers to the financial compensation for expenses incurred from using personal vehicles for business activities. Typically, this allowance is provided by employers to cover the cost of business use of a personal vehicle and is given in addition to the employee’s salary. For self-employed individuals, business owners, or independent contractors, vehicle-related expenses can be deducted from your annual tax return.

In Canada, the distance allowance is generally calculated based on a per-kilometre rate, designed to reimburse the costs associated with the ownership and operation of a personal vehicle for business reasons.

Annually, the CRA issues a standard per-kilometre allowance rate that organizations adopt to compensate employees for business travel.

Defining Business-Related Travel

The CRA defines business-related travel as any use of a vehicle directly connected to the fulfillment of one’s work responsibilities. This encompasses:

- Travel between multiple work locations.

- Attendance at business meetings and professional conferences.

- Client visits and customer service calls.

- Conducting work-related errands, such as supply runs.

Please note, commuting from home to your primary place of employment does not qualify as business travel.

CRA Distance Allowance Parameters

The CRA sets a specific per-kilometre rate annually for business-related travel. For the latest rates and detailed analysis, refer to our specialized article on the CRA’s distance rates for 2023 and previous years.

Tax Implications of the CRA Distance Allowance

An allowance is deemed non-taxable when it does not exceed the CRA’s prescribed per-kilometre rate. Should the allowance surpass this threshold, it becomes taxable income.

CRA Motor Vehicle Logbook Reimbursement Guidelines

For Employees: Employers may reimburse you for the business use of your personal vehicle. While not mandated by law, it is customary in Canada to provide this type of compensation. The most prevalent form of reimbursement is based on the official CRA automobile allowance rates, though some employers may opt to cover the actual operational costs of the vehicle for business travel.

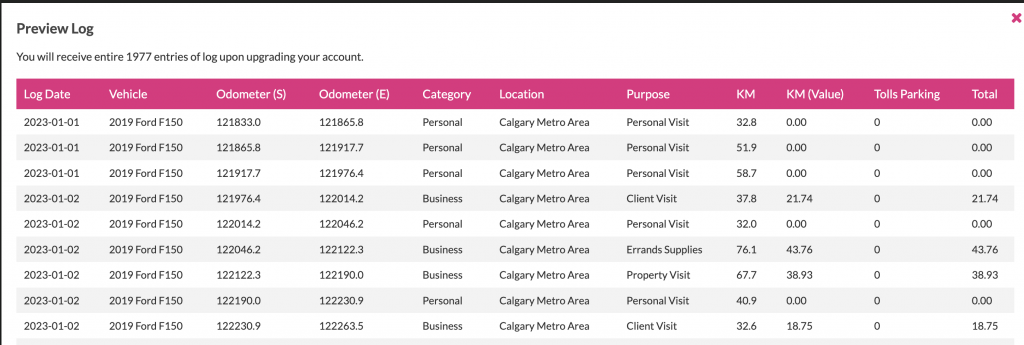

Employers typically specify the records required for reimbursement. These records, which form the basis of your motor vehicle logbook, should detail business trips, parking fees, tolls, and other incidental costs incurred during business travel.

For Employers: The CRA regards any payment to employees for business travel as an allowance. Such allowances are taxable unless they align with the CRA’s reasonable per-kilometre rates for the tax year in question.

To qualify as non-taxable, the allowance must:

- Only compensate for the number of business kilometres driven by the employee.

- Utilize a per-kilometre rate consistent with the CRA’s published rates.

- Exclude any other form of employee reimbursement for the same vehicle use.

For Self-Employed Individuals: As a self-employed professional using your vehicle for business, you are entitled to claim CRA distance deductions on your tax return. This includes a comprehensive list of vehicle expenses, from fuel and maintenance to insurance and interest on vehicle loans.

You can choose between two methods for logging business travel:

- Full Logbook Method: Requires meticulous record-keeping for every business trip within the fiscal year.

- Simplified Logbook Method: Involves maintaining a detailed logbook for one base year, after which a three-month sample can be used to estimate business use for subsequent years.

It’s important to retain your motor vehicle logbook records for six years following your tax submission.

By adhering to these guidelines, you can ensure your distance claims and reimbursements are accurately reflected and compliant with CRA regulations.