The IRS’s (Internal Revenue Service’s) requirements for tracking business mileage are either:

- Keep a logbook.

- Use an online mileage log.

The main requirement is to keep a record of all the miles you drive.

- The IRS allows you to deduct the miles driven on the job.

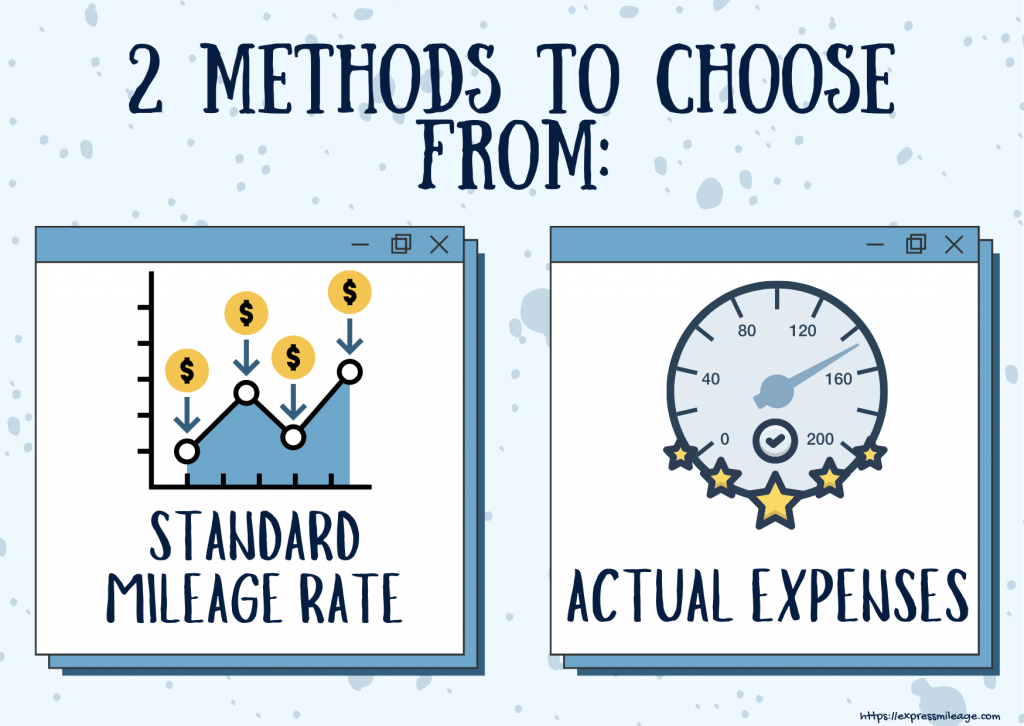

- You can either claim the standard mileage rate or you can use the actual cost of driving your vehicle.

- Tally your business miles.

- Whichever method you choose, make sure you’re using it correctly and that it’s accurate.

- Keep good records.

The IRS says you must be able to prove all of your deductions if you’re questioned about them by a tax auditor. If you’ve tracked your miles using an app or mileage-tracking device, keep it in a safe place (such as online storage or an external hard drive) so you don’t lose it if your computer crashes or is stolen. And make sure all of your devices show the same number of miles.

The IRS requires you to keep records of all work-related business mileage. These records must be maintained throughout the year and be available for IRS inspection upon request. Mileage tracking is a critical component of small business record keeping. By tracking your miles, you’re able to deduct any expenses that are associated with your job, including vehicle maintenance, insurance, parking fees, tolls, and gas. You may also be able to deduct the interest on your auto loan and car depreciation.

The IRS is always looking for ways to cut down on tax fraud, and one of the easiest ways to do that is to make sure that taxpayers are reporting all of their income. This means they’re keeping a close eye on the mileage log records you complete each year when you deduct business miles on your tax return. While you can use different methods to track your business miles, it’s best to be in compliance with IRS rules so you don’t get any unwanted attention from the taxman while he’s peering into your tax return. To ensure you’re not only in compliance but also following the IRS’s recommended method for tracking your miles, here are three tips:

1. Use the right logbook. The IRS recommends that most businesses track their mileage by using an IRS-approved mileage log or a similar recordkeeping method. There are two types of mileage logs: the mileage log and the summary record. Each has its own advantages. However, if you use neither, it’s likely that the IRS will question whether or not you spent enough time driving for business purposes.

2. Be consistent. If you’re keeping a physical log, be diligent about updating it whenever you spend money on gas or take a trip in your car. If you only record some of your expenses, it will be hard to tell if your numbers are accurate. This will ensure that all of your records are current and that you can easily track your progress toward a particular goal.

3. Read the IRS guidance and tax tips. The documents are just short and sweet, however, you’ll want to make sure you understand what they recommend. Educate yourself and, if you are an employer, or at the helm, make sure your staff is properly oriented.

Express Mileage is the fast, easy way to identify mileage expenses and manage your vehicle usage. It is available for all major mobile platforms, including desktop support. Moreover, it is verified to meet IRS log requirements.

How does it work? You may also visit our FAQs page.