No matter what kind of business driving you do, whether you are driving for Lyft, Uber, or another ride-sharing company, your own business, or you work as an independent driving for a truck, you need to know and understand the Internal Revenue Service or IRS standard mileage rate for the year in doing your business tax return. The IRS releases updates for taxpayers and the best way to get informed is to always visit their website.

Here is a table showing hypothetical recent 5 years of IRS standard deduction rates:

| Tax Year | Business Rate | Medical / Moving Rate | Charity Rate |

|---|---|---|---|

| 2023 | 58.5 cents | 18 cents | 14 cents |

| 2022 | 57.5 cents | 17 cents | 14 cents |

| 2021 | 56 cents | 16 cents | 14 cents |

| 2020 | 57.5 cents | 17 cents | 14 cents |

| 2019 | 58 cents | 20 cents | 14 cents |

Please note that these rates are illustrative. The actual rates for each year can be obtained from the IRS’s official publications. Accuracy for your business taxes is crucial to avoid any red flags from the IRS.

Keep in mind that business mileage rates are for business driving purposes only and any personal uses are not deductible. There are two methods in computing the mileage deductions, the other one is the Actual Expenses Method and it depends on which one you will use. Tips on Calculating Mileage Deductions will show you what is the difference between the two methods.

And lastly, after your computation, you can now add your business mileage expense to your tax return.

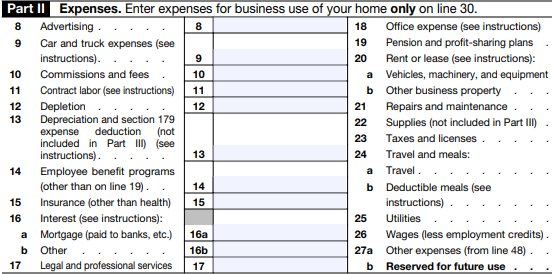

- For small businesses, you refer to Schedule C-form-1040, and on the form (PDF file), look for PART II No. 9 Car and truck expenses, and enter the amount.

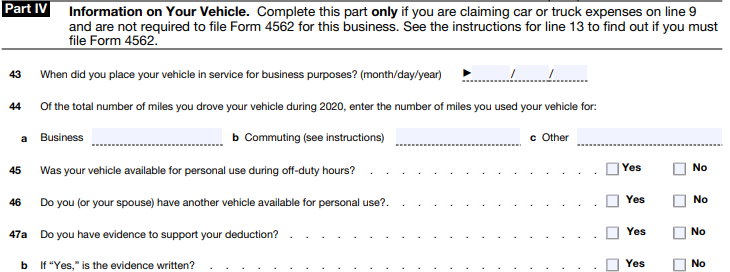

- Next, go to PART IV: Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 9 and are not required to file Form 4562 for this business. See the instructions for line 13 — Depreciation and section 179 expense deduction (not included in Part III) — to find out if you must file Form 4562.

You have to keep an accurate logbook for the entire year of all your business travel to have the best proof to support your deductions claims on your business mileage. Using an online mileage log maker is more beneficial as you get the maximum deduction you deserve. No more incomplete logbook that tends to forget to log by some of your employees. They can log the details in a minute, fast, easy and accessible.

GET STARTED today and choose your PLAN according to your business needs.