You’ve driven thousands of miles for your job and you want to take a tax deduction to get the biggest tax break possible. If you are using TurboTax, the process is easy to submit your mileage and maximize your tax deduction.

TurboTax allows you to enter your tracked mileage from within their tax software. This information will be collected within the Federal –> Income & Expenses section of the wizard. You first define the vehicle make, model and year that you drove for business purposes. Then you are asked a few simple questions about your vehicle.

Taking Mileage Deduction in Turbotax

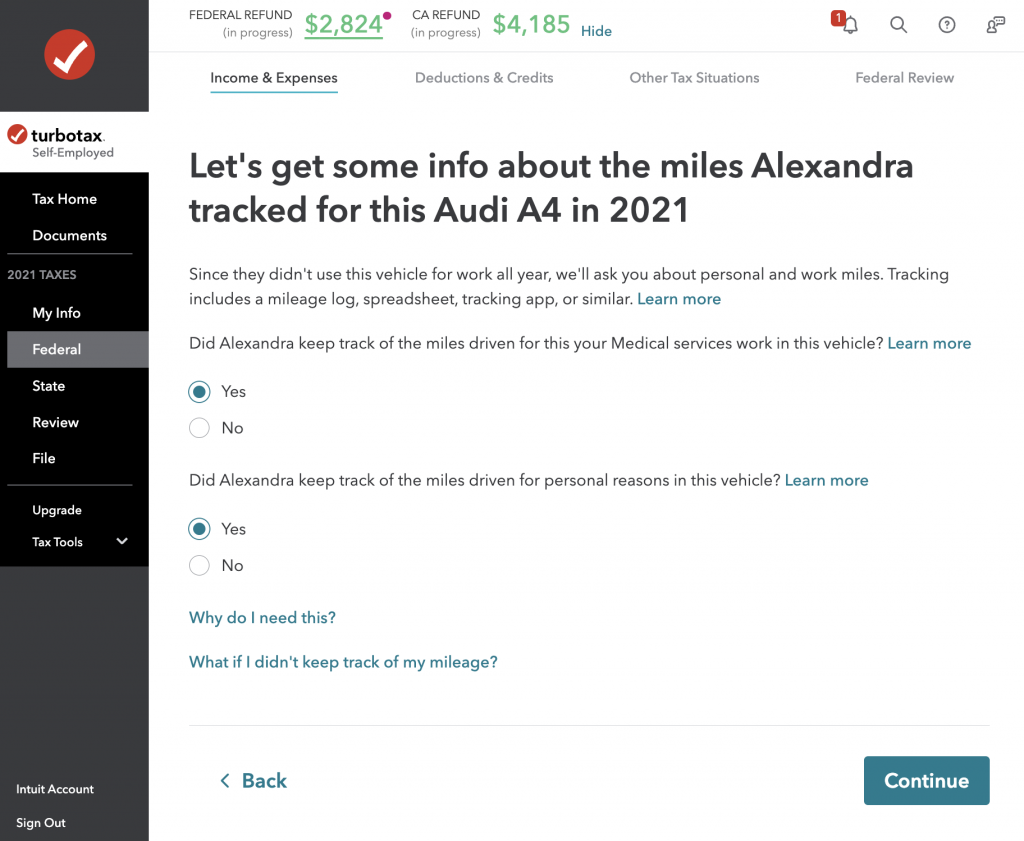

The most important questions you’ll want to answer to allow you to take the Standard Driving Deduction for your vehicle are:

- Did you keep track of the miles driven for [Type of Work] services work in this vehicle? – Since you have a mileage log generated with ExpressMileage, you can answer “YES” for this question.

- Did you keep track of the miles driven for personal reasons in this vehicle? – Since you were a PRO and made sure you added some personal miles to your vehicle mileage log – you can answer “YES” for this Turbotax question.

Need to Create a Mileage Log?

Effortless. IRS Compliant. All in 5 Minutes.

- GENERATE A DRIVING LOG IN MINUTES

- AUTO-POPULATE AND RECURRING DRIVES

- GET YOUR MAXIMUM TAX DEDUCTION

Entering Mileage Driving for Business and Personal

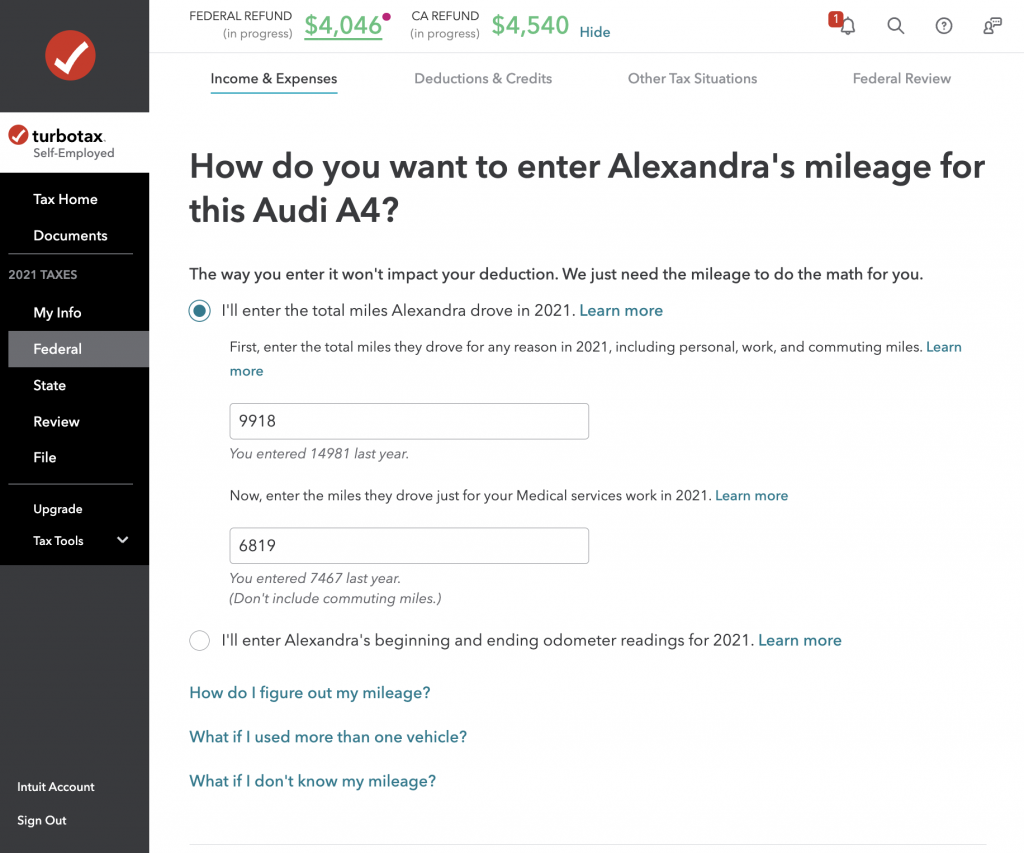

If you’ve answered YES to both of the initial Turbotax mileage questions about your vehicle, you’ll be prompted to enter either:

A) The total miles driven for the vehicle and the total miles driven for work

OR

B) The beginning and ending odometer readings for your vehicle for the year

Keep in mind the idea here is that Turbotax will do the math on the business and personal mileage for you. From your mileage log that you created and downloaded using ExpressMileage, you can locate these values in the PDF or spreadsheet and enter them into the Turbotax mileage log information questions.

Calculating Mileage Tax Deduction in Turbotax

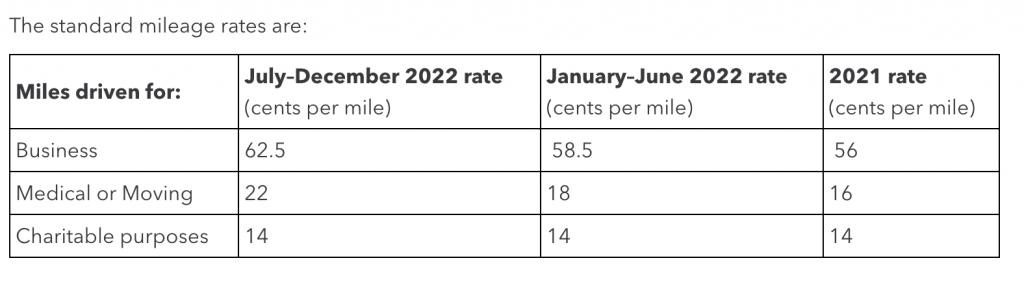

Upon entering your mileage into Turbotax, the software will automatically calculate your tax deduction based on the Standard Deduction Rate for the current tax year. This standard mileage rate includes fuel, insurance, maintenance, repairs, and wear and tear. In addition, you can also deduct highway tolls and parking fees from your taxes.

Turbotax’s calculation of the tax deduction value should closely match the value that is displayed on the mileage log you created with ExpressMileage.

Submitting Your Mileage Log to IRS for Tax Deduction

Keep in mind you don’t actually submit your mileage log when you send your taxes to the IRS (E-File or snail mail). You only are required to produce the mileage log if you are audited.

No matter if you drove 500 miles for business or 50,000 miles – you deserve the tax deduction for the wear and tear on your vehicle. Be sure to create a mileage log using our advanced Mileage Log Generator and take the maximum tax deduction for your driving that you earned!