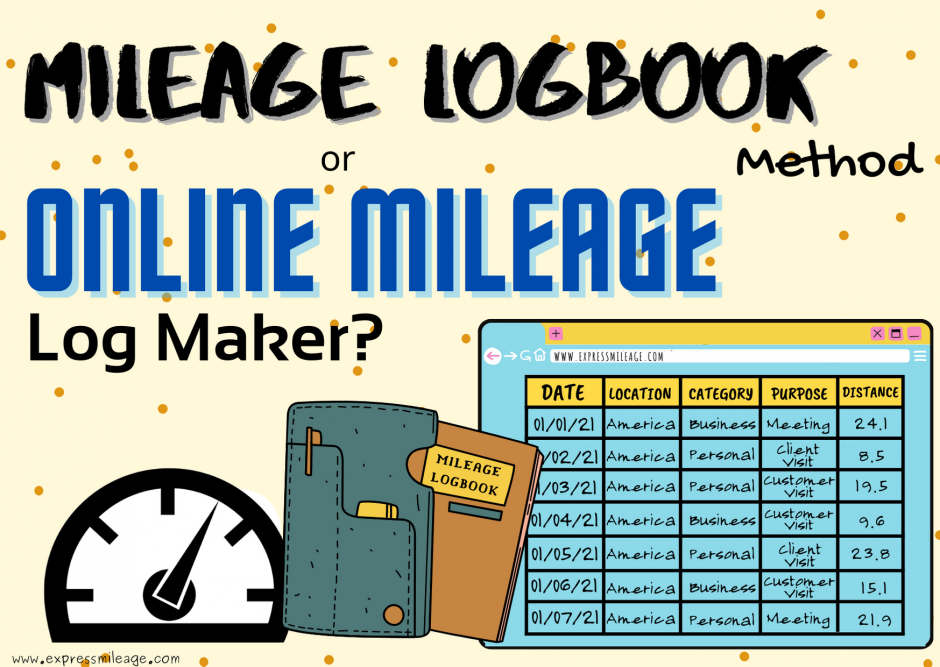

Which one is better when claiming for business mileage deductions, a logbook method or an online mileage log maker? Both are helpful but in different ways.

For calculation, it is crucial to always record all the data needed for each business trips such as:

- Time and date of the drive for business purposes

- Starting point

- Destination or place of the drive

- The business purpose of the drive

- The total distance of the drive or odometer readings

Whether you use a paper mileage log or an online mileage log, these details are a must. Aside from business trips, the IRS may also want to know your personal-related errands (personal trips) for verification purposes.

You can refer to IRS standard mileage rates for the years 2020, 2021, 2022 or 2023 for accurate rates.

The good thing about the paper mileage log method is that it is cheaper than the online mileage log maker. You can buy it for $5 or less during the sale season. They are also acceptable by the IRS during the audit. BUT, there are various problems with using this kind of method: time-consuming, long-term process, and documentation.

- Time-consuming

Technically, you have to track each trip, whether it is for business or personal purposes. You have to write down your mileage immediately right after you’ve stopped your car or you may want to write down all the details at the end of the day but that will take up more time on your end especially when forgetfulness strikes you. And you will do that every day, multiple times on each trip you have. Imagine your life for the whole year, it can really be stressful.

- Long-term process

Sounds easier when you think writing details for every car stop may only take one minute or less but it can be harder than you think. Not every day is a good day at work, it can be a demanding day for you due to a lot of business errands or a bad mood for you. Admit it, personal issues may also bring so much stress at work and it can be a bad lazy day. You may be less patient documenting every single trip and every single stop.

- Documentation

It is a proper document to use and you can file it or keep it in your cabinets in the office. At the end of the year, you or your accountant will calculate your deduction and you need to read and check all the writing mileage records. Again, it is a time-consuming and long-term process on your end. A paper mileage log is easy to misplace, lose, or get damaged, and keeping your files for a maximum of seven years will not give you the confidence that all records will be intact.

ExpressMileage’s benefits are proven, trusted, and reliable by many business owners. It automatically calculates your total driving mileage for the entire year in a matter of seconds. Records are safe and secured and you never have to worry about losing all your mileage logs even after seven years. For audit purposes, you and your records are always ready for any possible verification.

All ExpressMileage Logs are in IRS compliant format. The mileage log can be downloaded in PDF or XLS spreadsheet format. You can easily modify the XLS spreadsheet as needed. Feel free to visit the Express Mileage FAQ page.