Employees Mileage Reimbursement

Every year, the IRS sets a standard mileage reimbursement rate therefore employees, and employers can utilize it for tax…

September 20, 2021

Every year, the IRS sets a standard mileage reimbursement rate therefore employees, and employers can utilize it for tax…

September 20, 2021

Keeping a mileage record for your medical travels is crucial as this will help you claim your medical mileage…

August 7, 2021

Making a mileage log for your medical trips is significant for you to get the medical mileage deduction. Using…

July 24, 2021

Medical expenses deduction is one of the tax reasons why you need to track your miles for your trips.…

July 13, 2021

The Internal Revenue Service or IRS considers medical care expenses are the following: cost for your medical diagnosis cost…

July 4, 2021

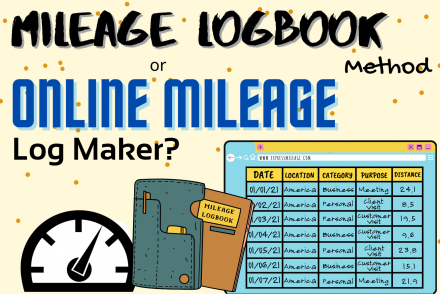

Which one is better when claiming for business mileage deductions, a logbook method or an online mileage log maker?…

May 29, 2021

When it comes to business records, everything should be accurate and complete with supporting documents to show. The vehicle…

April 29, 2021

The Internal Revenue Service or IRS accepts only business trips purposes on your business mileage deductions. The personal trips…

April 17, 2021

As a business owner, days are just too busy and you have no time to deal with other important…

March 28, 2021

Business owners and self-employed individuals are qualified to claim a business mileage deduction. The IRS only considers business trips…

March 14, 2021