As a business owner, days are just too busy and you have no time to deal with other important tasks, and being reliant on your employees is one of the answers to your predicament. You assigned an employee to handle the task for you and one certain factor is running errands. It could be:

- Driving to pick up something like office supplies or any business-related materials

- Driving to an out-of-town conference meeting or just to another branch of the company for a gathering

- Driving to meet customers to deliver orders or business proposal files

- Driving to the bank for a business activity

- Or any other business-related errands

If all the business purpose tasks mentioned above are performed by employees using their private vehicles, an employer offers mileage reimbursement. What is mileage reimbursement?

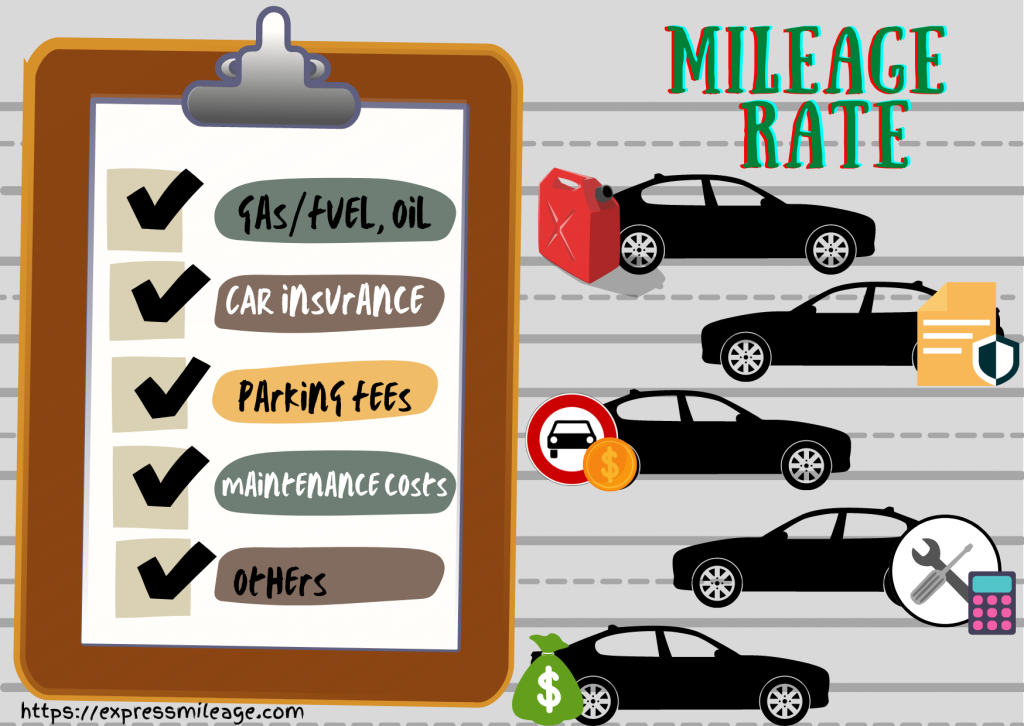

Mileage reimbursement comes in when an employee is on a mission for work and needs to hit the road by using his car for business purposes. An employee is qualified for a refund of the mileage and travel costs. Mileage rate includes:

- Gas/Fuel, Oil (fuel costs vary significantly by geography)

- Car Insurance

- Parking fees

- Maintenance costs

- Other personal vehicle-related costs – depreciation, etc.

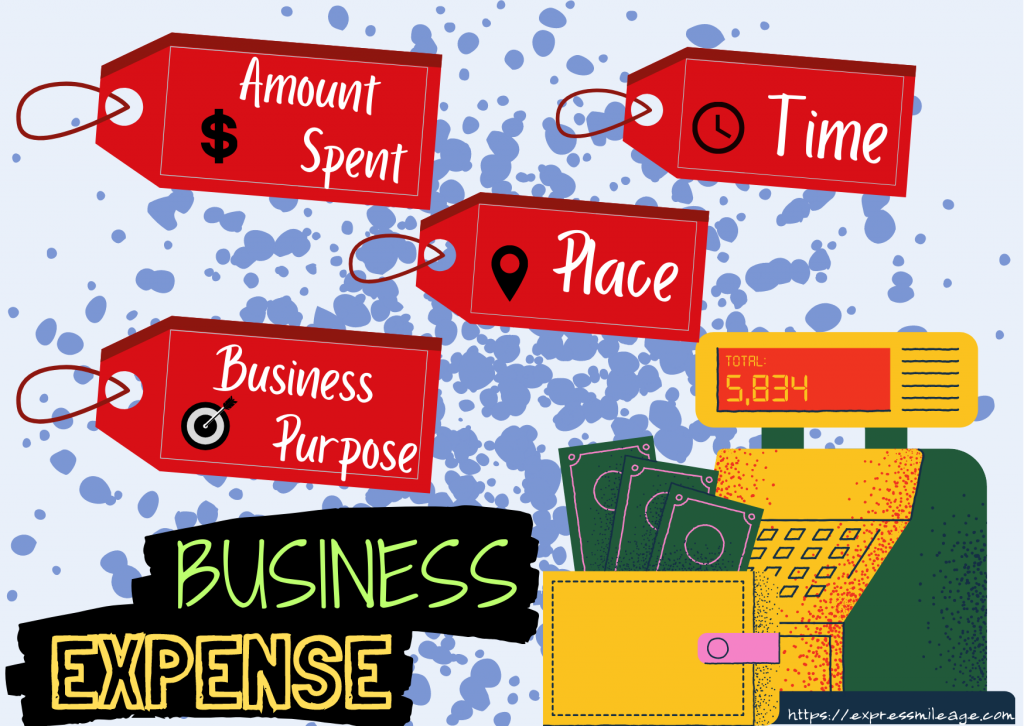

Mileage reimbursement is a beneficial opportunity to receive tax reductions for both the employee and the employer. However, an employee must provide proof that the business expense is valid.

- The amount spent

- The time

- The place

- The business purpose of the expense

The employee must submit it within a reasonable period. Reporting the same day is recommended or after the tasks are done.

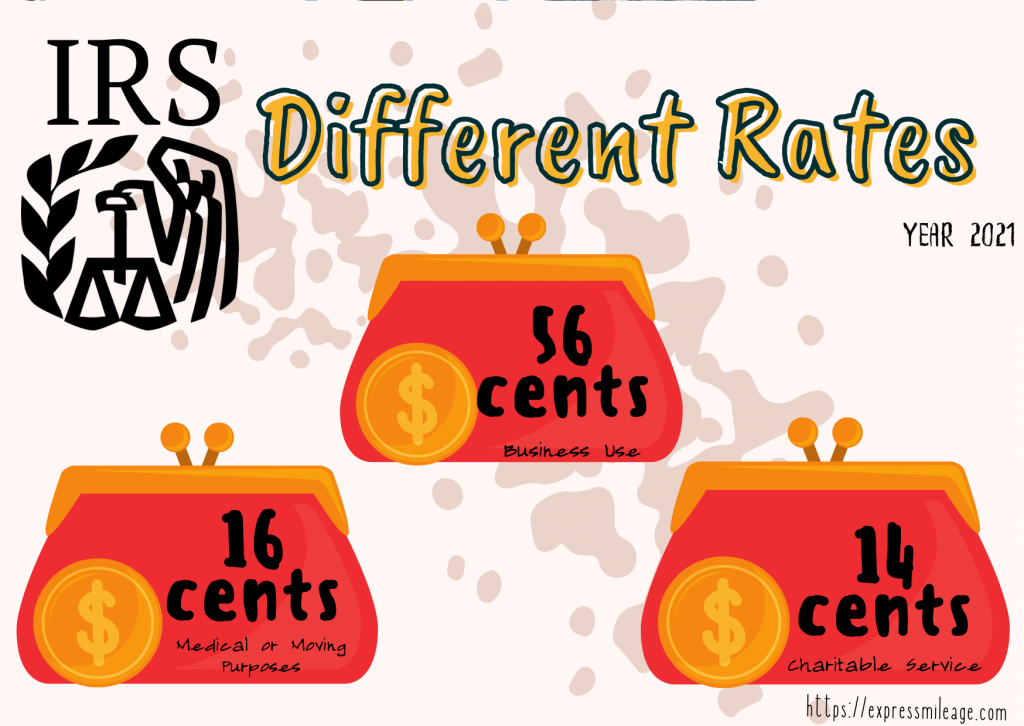

The IRS publishes a different rate every year and for the year 2021, the rates are:

- 56 cents per mile driven for business use

- 16 cents per mile driven for medical, or moving purposes for qualified active-duty members of the Armed Forces

- 14 cents per mile driven in service of charitable organizations

These are the rates for the year 2020 or the table summary from 2011-2021 for your reference.

Administering the rules of mileage reimbursement to your employees means understanding your least obligations under both federal and state law. Yes, it is crucial to meet legal requirements and these rules apply to any business, regardless of company size. And on the employees’ end, you are giving reasonable reimbursement without increasing their wages, overcompensating, and incurring additional taxes but building an efficient rate fairly.

Do not forget to make a mileage log and obliged your employees to record everything accurately and timely on the mileage log maker. Generating a driving log can be done in minutes and it is verified to meet the IRS log requirements. You can minimize human errors as well when it comes to logging data and calculations. How does it work? You can watch the 30 seconds video or visit the FAQ’s page and then decide what Membership Plan do you prefer. It can be Standard, PRO, or Elite Plan depending on your company size.

As an employer, you should communicate clearly to your employees about your reimbursement rate and policy. To whom they should send the expense reports for approval and possible time they will be expecting the reimbursement and what payment method to be used. It should be clearly stated to your employee to avoid any possible issue.